All Categories

Featured

[/image][=video]

[/video]

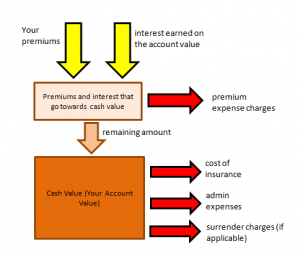

Withdrawals from the cash worth of an IUL are generally tax-free up to the quantity of costs paid. Any withdrawals over this quantity may be subject to tax obligations depending on policy framework.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the person is over 59. Properties taken out from a standard or Roth 401(k) prior to age 59 may sustain a 10% fine. Not specifically The cases that IULs can be your own financial institution are an oversimplification and can be misleading for many factors.

However, you may go through upgrading linked health concerns that can impact your continuous costs. With a 401(k), the cash is constantly your own, consisting of vested employer matching despite whether you quit adding. Risk and Guarantees: First and leading, IUL policies, and the cash value, are not FDIC insured like conventional checking account.

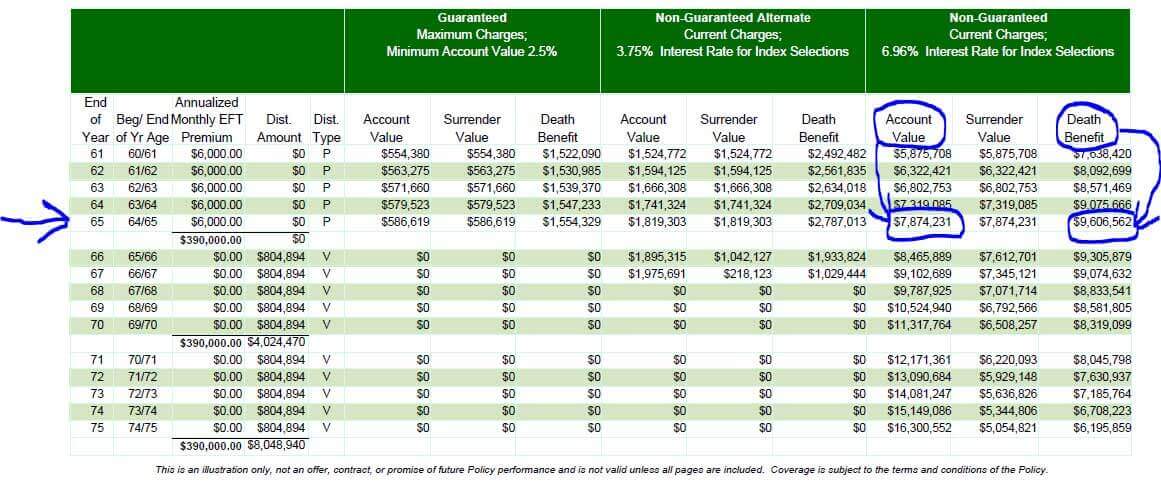

While there is generally a floor to avoid losses, the development capacity is covered (implying you may not completely profit from market increases). A lot of experts will certainly agree that these are not similar items. If you desire survivor benefit for your survivor and are worried your retirement financial savings will not suffice, then you might wish to consider an IUL or various other life insurance product.

Certain, the IUL can provide accessibility to a cash money account, but once again this is not the primary function of the item. Whether you desire or need an IUL is a very individual inquiry and depends on your key financial purpose and objectives. Listed below we will try to cover benefits and limitations for an IUL and a 401(k), so you can additionally mark these products and make a much more enlightened decision pertaining to the finest means to manage retirement and taking treatment of your loved ones after death.

Max Funded Iul

Loan Prices: Car loans versus the policy accumulate rate of interest and, otherwise paid back, decrease the survivor benefit that is paid to the recipient. Market Participation Limitations: For the majority of policies, investment growth is connected to a stock exchange index, but gains are usually covered, restricting upside potential - iul instruments gmbh. Sales Practices: These policies are often offered by insurance coverage representatives that might emphasize benefits without fully explaining prices and dangers

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

While some social media experts recommend an IUL is a substitute product for a 401(k), it is not. These are various products with various purposes, features, and prices. Indexed Universal Life (IUL) is a sort of permanent life insurance policy policy that also offers a money worth element. The cash worth can be used for several objectives consisting of retirement cost savings, extra revenue, and various other financial demands.

Latest Posts

Equity Indexed Universal Life Insurance Contracts

Understanding Indexed Universal Life Insurance: Pros And ...

Index Universal Life Insurance Calculator